Hanwha and Philly Shipyard: The Icebreaking Connection

Hanwha brings experience with ice-capable vessels to a shipyard that has shown interest in building icebreakers.

Last week brought yet more news surrounding possible international collaboration in building icebreakers as both the White House and Davie released statements about foreign investment in U.S. shipyards. We will look at the July 29th announcement by the White House concerning “Private Sector Investments in American Maritime Industries” soon.

For today’s post, we’re going back to June, when it was announced that Philly Shipyard had been sold to Hanwha Systems and Hanwha Ocean, two subsidiaries of the Korean conglomerate formerly known as Daewoo. In case you missed the announcement, here are the details (from gCaptain):

U.S. shipbuilder Philly Shipyard will be sold to South Korean conglomerate Hanwha in a deal value at $100 million. The confirmation comes after months of rumors that the two parties were exploring an acquisition.

Oslo-based Philly Shipyard ASA announced Tuesday it has agreed to sell Philly Shipyard, Inc., its sole operating subsidiary, to Hanwha Systems and Hanwha Ocean, two Hanwha subsidiaries, via a share purchase agreement (SPA) with a cash consideration of $100 million….

Philly Shipyard, based in Philadelphia, Pennsylvania, is known for being one of the few American shipyards capable of constructing ocean-going ships in compliance with the Jones Act. Currently, the shipyard is engaged in several commercial and government projects with a backlog until 2027, including the construction of five federal training and humanitarian ships for the U.S. Department of Transportation’s Maritime Administration. Commercial projects include an offshore wind Subsea Rock Installation Vessel (SRIV) for Great Lakes Dredge and Dock and three 3,600 TEU containerships for U.S.-based shipping line Matson.

Secretary of the Navy Carlos DelToro responded positively to the news:

Hanwha’s acquisition of Philly Shipyard is a game-changing milestone in our new Maritime Statecraft. This will bring good paying union jobs to Philadelphia, a city with a 250-year relationship with the U.S. Navy. Knowing how they will change the competitive U.S. shipbuilding landscape. I could not be more excited to welcome Hanwha as the first Korean shipbuilder to come to American shores—and I am certain they will not be the last.

Hanwha sees this purchase as creating an opportunity to bring its knowledge and experience to the U.S. market. From Hanwha’s press release (bold is mine):

Hanwha Systems and Hanwha Ocean announced the acquisition of Philly Shipyard, a leading U.S. shipbuilder that has delivered approximately half of the large U.S. Jones Act commercial ships in the United States since 2000. Hanwha Systems and Hanwha Ocean will together invest $100 million to acquire Philly Shipyard to further their strategies to expand their global defense and shipbuilding activities.

Philly Shipyard is a public company controlled by Aker ASA1, a Norwegian industrial investment company with ownership interests in energy, green technologies, and marine biotechnology. Philly Shipyard produces vessels that are compliant with the Jones Act, a federal law that requires vessels used in domestic trade to be built in U.S. shipyards. Established in 1997, Philly Shipyard supplies around 50% of the largest U.S. commercial vessels, including tankers and container ships. In addition, Philly Shipyard constructs training vessels for the U.S. Maritime Administration (MARAD).

“The opportunity to collaborate with Philly Shipyard, a significant shipbuilder with a storied history, is an exciting strategic opportunity that will allow Hanwha Systems to deploy its state-of-the-art naval systems and associated technologies in the U.S. market,” said Sung-Chul Eoh, CEO of Hanwha Systems.

Hanwha’s emphasis the Jones Act and Naval Systems seems to indicate that this deal with Philly will help it to enter the Jones Act and U.S. Government markets. Not mentioned, though, is something that could prove to be of great interest- Hanwha’s experience with ice-capable designs.

NOTE: In case you missed the footnote above, I want to highlight here that although both Aker Arctic (the Finnish icebreaker design firm) and Aker ASA have ‘Aker’ in their name, they are separate companies with no direct connection. To put it simply, Aker ASA’s ownership stake did not bring any Aker Arctic resources to Philly Shipyard.

Meet Christophe de Margerie

From 2016-2019, under its previous name of Daewoo Shipbuilding and Marine Engineering or simply DSME, Hanwha Ocean built 15 icebreaking LNG carriers for use along Russia’s Northern Sea Route (NSR).

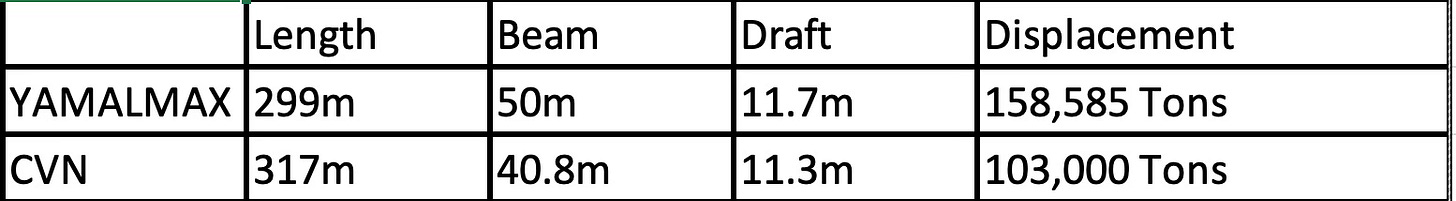

These vessels- known as Yamalmax- are larger than Nimitz-class aircraft carriers.

From Aker Arctic, concerning the first Yamalmax vessel Christophe de Margerie:

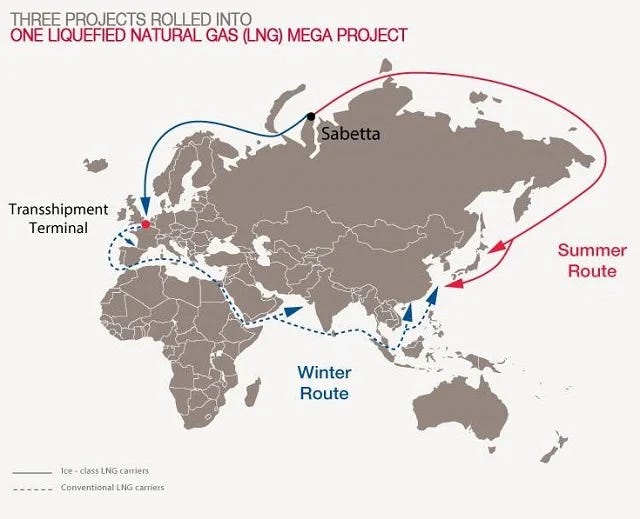

The specifications of the Christophe de Margerie make her a unique vessel. She was assigned an Arc72 ice class, the highest ice class amongst existing merchant vessels. She is capable of sailing independently through ice up to 2.1 metres thick. According to plans, she will sail along the Northern Sea Route westward from Sabetta all year round and eastward for six months of the year (July to December). Previously, the summer navigation window on the Northern Sea Route was limited to only four months with an icebreaker escort.

When it comes to breaking ice, these vessels are comparable to the USCG’s Heavy Icebreaker Polar Star, which can officially break 6 ft of ice at 3 knots and is capable of penetrating 21 ft ice ridges3. In ice trials, the Christophe de Margerie made 7.2 knots (astern) and 2.5 knots (ahead) in 1.7m (5 ft) thick ice and penetrated a 15m (49ft) ice ridge. A double acting ship, the Christophe de Margerie is designed to sail forward in open ocean and lighter ice conditions but breaks the toughest ice in the astern direction. In a post on X/Twitter, Aker Arctic observed that the Christophe de Margerie outperformed an Arktika-class nuclear powered icebreaker in ice ridge penetration during ice trials. Christophe de Margerie was going astern, using her modern azimuth propulsion to grind through the ridge, while the Arktika was ramming and backing.

In 2018, Christophe de Margerie set the record for an unescorted crossing of the NSR (gCaptain):

The vessel, which is owned and operated by Russian shipping firm Sovcomflot, set the new record while transporting a cargo of liquefied natural gas eastward through the NSR from the Yamal LNG plant at the Arctic port of Sabetta in Russia to the port of Tangshan, China.

During the NSR crossing, Christophe de Margerie covered a distance of 2,360 nautical miles in just 7 days and 17 hours from Sabetta to Cape Dezhnev, marking the easternmost point of mainland Asia. The time makes for an average speed of an impressive 12.8 knots….

“This remarkable, safe passage across the NSR has required the crew’s utmost attention and concentration,” said Igor Tonkovidov, Executive Vice President of Sovcomflot. “Ice conditions along the route were severe, especially in the East Siberian Sea, and the vessel experienced navigation in extended periods of limited visibility. The navigational and hydrographic situation within Arctic regions remains as challenging as ever.

These vessels are in use today carrying LNG from the Novatek’s non-sanctioned Yamal LNG terminal.

Year-round Arctic LNG carriers

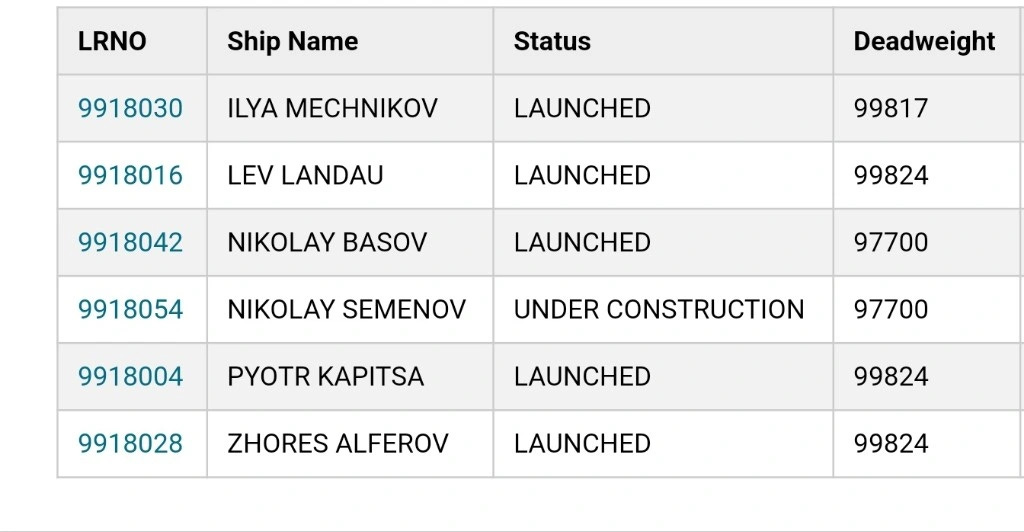

In 2010, Aker Arctic and DSME, along with Novatek, developed a follow-on vessel to meet the needs of Novatek’s Arctic LNG 2 project. DSME signed an agreement to build six vessels that would be capable of year-round operation along the NSR. They have a new hull design featuring a bow more optimized for icebreaking, are narrower (to more easily use channels opened by icebreakers, if needed) and are slightly more powerful (51 MW instead of 45 MW) than the original Yamalmax design.

Sanctions on Russia and those specifically on the Arctic LNG 2 project mean that although five of the six vessels are complete, none have entered service. DSME cancelled its contract with Sovcomflot for three vessels when sanctions on Russia resulted in non-payment. (Note: Total contract cost of $872 million). However, DSME continued to build these three vessels alongside the three ordered by Mitsui OSK Lines (MOL) of Japan.

MOL had originally planned to operate its three vessels on a time charter with Novatek’s LNG 2 project. Sanctions mean that it is unable to do so, but it is unclear what this means for the future:

“Our contractual obligation is that if we cannot provide the service to Arctic LNG 2, we have to sell our vessel to Arctic LNG 2,” MOL President Takeshi Hashimoto explained in an interview with Bloomberg this week. However, “there is a sanction that says we should not do that deal with Arctic LNG 2. So it’s a bit complicated.”

Yes, this is all a bit complicated. Novatek’s not-yet-complete LNG 2 project is subject to sanctions. But much of Europe depends on natural gas from Yamal, so LNG exports from there continue and are unlikely to face sanctions. At this point, it is not clear what will happen to these six vessels (names below).

The bottom line here is that Hanwha, in partnership with Aker Arctic, has experience developing and building icebreaking vessels that are large, capable, and powerful. And at $862 million for three of them, relatively affordable.

Philly Shipyard and the Heavy Polar Icebreaker Program (Now Polar Security Cutter)

I’ve been following the U.S. Coast Guard’s icebreaking program since 2017 and extensively covering the problems plaguing the Polar Security Cutter (PSC) program since I began this publication. I believe that many of the problems are directly attributable to a lack of experience with modern icebreaking by the U.S. Coast Guard and the companies to which the USCG awarded the contract. VT Halter and TAI, which had no experience with icebreakers, were awarded the contract over two other bidders. One of the losing bids had significant experience with icebreakers:

In addition to the winning bid, other offerings came from Fincantieri Marinette Marine (FMM), which included Vard and Aker Arctic as partners, all very experienced in the design and construction of ice-class vessels, including the construction of Coast Guard icebreakers that trawl the Great Lakes region.

Another unsuccessful bid was submitted by Bollinger, a Gulf Coast shipbuilder out of Louisiana.

Those following the PSC know that VT Halter was bought by Bollinger in 2022 for the low price of $15 Million.

The experienced team of Fincantieri, Vard, and Aker Arctic were partnered with the Philly shipyard. For a look at what might have been, you can read my overview of another Vard/Aker Arctic project, Le Commandant Charcot:

Concluding Thoughts

Hanwha’s purchase of Philly Shipyard brings significant, recent experience in the design and construction of large ice-capable vessels to the United States. In the past eight years, Hanwha (along with Aker Arctic) has designed and built 21 large ice-capable LNG carriers for use along Russia’s Northern Sea Route. With this experience, Hanwha’s acquisition of Philly Shipyard can only help the U.S. Shipbuilding Industry.

Some have noted that Philly Shipyard was previously owned by a Norwegian company, Aker ASA. Note that Aker ASA is a holding company. It is not the same company as Aker Arctic (the Finnish icebreaking design company), and did not bring foreign expertise in icebreakers to Philly shipyard.

Philly Shipyard’s earlier partnership with Fincantieri, Vard, and Aker Arctic to bid for design and construction of the U.S. Coast Guard’s PSC shows that the Philly Shipyard had an interest in building icebreakers.

This conversion of interest and capability may mean that Philly Shipyard hopes to play a role in future icebreaking construction for the U.S. Coast Guard.

If so, it is not alone. The statements on July 29 by the White House and Davie strongly suggest that Davie, through a major investment in yet unnamed U.S. shipyard, intends to bring its expertise to building icebreakers in the United States.

Time will tell exactly how this plays out. Still, it is good news that capable foreign companies are investing in U.S. shipbuilders.

Thanks for reading. If you like what you’ve seen, press the heart and subscribe. Icebreakers and shipbuilding are in the news frequently, so subscribing is the best way to ensure that you keep up with the news and what is actually means for U.S. icebreaking capabilities. Consider sharing this post with a friend or fifteen; it takes me some time to research and write these articles, so I’m happy to see them spread far and wide. It’s important to keep this conversation going.

Until next time.

All the Best,

PGR

This arrangement is a bit complicated. Aker ASA owns Aker Captial AS which is the majority shareholder in Philly ASA, the Norwegian holding company that owns Philly shipyard. Aker ASA also owns Aker Solutions, which has a minority stake in Aker Arctic (the Finnish icebreaking design firm). This is only an ownership connection, there is and was no direct cooperation between Aker Arctic and Philly Shipyard.

Arc7 is a Russian ice-class designation. Arc7 is currently the highest ice class awarded to a merchant vessel and is roughly equivalent to Polar Class 3.

The Polar Star can likely handle tougher ice conditions, but this is the capability cited in official U.S. Government reports.

Another well-researched and interesting article for Sixty Degrees North. The Arctic is fast becoming an area of intense competition, and Antarctica is not far behind. Both are under reported and but are important to monitor if you have an interest in security issues.

Now, if we could just get the government out of the way...