March 2024 Update to Polar Security Cutter Report Highlights Shortage of Workers, Cost Overruns, Continued Delays

My summary of the additions/changes in the latest iteration of Ronald O'Rourke's excellent report for the Congressional Research Service

Note: This is part of a continuing series on Arctic policy and icebreakers. To look at previous articles, click here.

On March 27th, Ronald O’Rourke updated his Congressional Research Service (CRS) report on the Coast Guard’s Polar Security Cutter (PSC) Program. The previous version was released on January 17, 2024.

If you haven’t read these reports before, they are a great primer on the issues facing the U.S. Coast Guard (and the U.S. Government) as it works to replace its aging polar icebreakers. I’ve been reading these reports since 2017.

I’ve summarized some of the differences in the March 2024 report (from the January report) below, so that you don’t have to read the two reports side by side.

The U.S. Coast Guard is now buying four or five PSCs:

Updates language to reflect the Coast Guard’s 2023 fleet mix analysis concluding that the USCG needs eight or nine polar icebreakers, including four or five heavy icebreakers. This change occurs throughout the report.

The Coast Guard PSC program aims to acquire four or five new PSCs (i.e., heavy polar icebreakers), to be followed at some later point by the acquisition of new Arctic Security Cutters (ASCs) (i.e., medium polar icebreakers). (Summary)

The lack of Polar Icebreakers is affecting NORTHCOM:

Adds a quote from Commander, U.S. Northern Command on the importance of polar icebreakers:

At a March 14, 204, hearing before the Senate Armed Services Committee, Air Force General Gregory M. Guillot, the Commander of the U.S. Northern Command (USNORTHCOM), when asked to comment about numbers of U.S. icebreakers for supporting U.S. operations in the Arctic in a context, stated that “we’re severely outnumbered,” and that “we do appreciate that the Coast Guard is—is procuring more icebreakers. But even with those, we will be severely outnumbered. And that does limit our freedom of maneuver in that region.” (page 5)

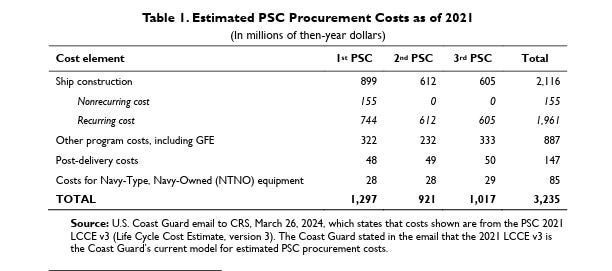

The estimated cost of the first three vessels is rising:

Updates cost chart. Although based on 2021 data, CRS did not get this “update” until March 26, 2024. This change shows a more than $500 million cost increase from the previous report. (page 8)

Previous chart:

A lack of available skilled workers along the Gulf Coast adds risk to the PSC and other U.S. Coast Guard shipbuilding plans:

Adds a section under the heading PSC Program: Delay in Construction and Delivery of First Ship concerning a potential delay due to lack of workers/competition between shipyards for same workers along the Gulf Coast (emphasis is mine):

A January 22, 2024, press report states:

U.S. Navy programs have made recent headlines for falling behind schedule. Now, Coast Guard officials say their service, too, fears several of its acquisition programs are at risk of delays, as four separate shipbuilders vie for limited workers along the Gulf Coast.

Rear Adm. Chad Jacoby, the assistant commandant of the Coast Guard for acquisition, said this month workforce challenges—specifically, needing more highly trained welders and design engineers—are contributing to delays on the Polar Security Cutter program at Bollinger Mississippi, formerly VT Halter Marine.

“If you look across all of our construction programs, every shipyard says they’re going to hire 1,000 or 2,000 more people prior to executing the contracts that we have in place. They all happen to be on the Gulf Coast, so if you add up all those numbers, it’s probably physically impossible for every one of those individual shipyards to hire 2,000 more people” to support on-time ship deliveries, Jacoby said on a Jan. 11 panel at the Surface Navy Association annual conference.

He told Defense News after the panel he is specifically concerned about Bollinger Mississippi in Pascagoula and its Polar Security Cutter; Eastern Shipbuilding Group in Panama City, Florida, which is building the first four Offshore Patrol Cutters; Austal USA in Mobile, Alabama, which will build the next 11 OPCs; and Birdon America, a Denver based company that will build the Waterways Commerce Cutters with a number of Louisiana- and Alabama-based companies.

“It is one workforce across many states,” the admiral said of the Gulf Coast region. “As each shipyard says they’re going to hire people, they’re definitely competing against each other.” (page 20-21)

Updated schedule coming soon?

Adds a section under the heading PSC Program: Delay in Construction and Delivery of First Ship stating that an updated program schedule is expected to be completed later this year:

A March 20, 2024, press report states:

The Coast Guard is currently working with the shipbuilder, Bollinger Shipyards, to “rebaseline [the program],” which will result in a new program schedule that is expected to be completed “later this year and will be critical to informing future budget requests,” a service spokesperson wrote in an email….

… the reevaluation of the program means that the entire program schedule will be revamped, and that schedule will not be made available until later this year, the service said. (page 21)

The use of parent designs might not be helpful:

Adds a section questioning the value of using parent designs, citing a journal article from the Society of Naval Architects and Marine Engineers:

The U.S. Navy has experimented with many approaches to design and build its ships. Using an existing design as the “parent” design, also referred to as “modified-repeat” design, is on its face an attractive option. Many acquisition executives, program managers and some ship design engineers believe that a design based on a parent has fewer technical risks than a new “clean sheet of paper” design and therefore the time and cost to design and build it will be reduced. They assume early in the ship acquisition program that “the design is mature” and because of that fewer problems will be encountered in completing the design and savings will thus be accrued. Yet, a number of naval ships based on a parent design have in fact experienced unanticipated cost and schedule growth during construction as well as technical problems during their in-service life. The authors will examine some of these ship designs which were based on an existing design and/or prototypes and highlight the fallacies of such beliefs and assumptions. The authors will also briefly describe the development and use of more physics-based design tools during early stage design that can reduce the risks of a new clean sheet ship design through design space exploration and actual design maturation. (page 22)

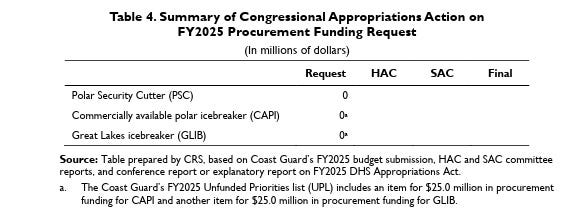

Updates Congressional Action:

Closes out the USCG’s FY 2024 appropriation action, adds the FY 2025 request, and notes the items on the FY 2025 Unfunded Priorities List concerning the PSC /icebreakers: (page 34)

Another look at the Polar Sea?

An explanatory statement along with the FY 2024 appropriation:

In addition, within 120 days of the date of enactment of this Act, the Coast Guard is directed to provide a report that assesses the viability of reactivating Coast Guard Cutter Polar Sea. The report shall include an analysis of the material condition of the hull and cost and timeline estimates for a full overhaul of the vessel, including the renewal of the cutter’s propulsion, mechanical, electrical, communication, and support systems. (page 37)

Things that remain, but should be updated:

The report references the same, out of date table listing polar icebreakers operated by other countries. (The table is based on data provided by the USCG, as of April 4, 2022). Making an apples-to-apples comparison of icebreakers is always challenging, but I question the methodology (unknown) of this particular table. It seems very similar to a previous chart that categorized icebreakers by horsepower. As such, it does not seem to effectively compare modern azimuth/dual acting icebreakers and traditional icebreakers (Table B-1, page 54).

The report continues to ignore the true capability of foreign shipyards. For example, on page 33, the report refers to two nuclear icebreakers that were built in Finland but had their reactors installed in Russia. The report then states that “All other Finnish-built icebreakers shown in Table B-1 (whether operated by Finland or other countries) could be considered, based on their brake horsepower (BHP), to be medium or light polar icebreakers.” BHP is an outdated measure of icebreaking capability, as modern icebreakers can do much more with significantly less power. For more info, see my recent report on Finland’s Icebreakers.

Relevant to this has been news out of Canada concerning their Polar Icebreaker Program. In a tweet about this, Finnish naval architecture firm Aker Arctic (which is part of the Canadian project) highlights the declining importance of propulsion power in icebreaker designs:

Summary:

The U.S. Coast Guard does not have enough icebreakers for U.S. NORTHCOM to accomplish its mission.

The USCG now wants 4-5 Polar Security Cutters, not just 3.

The Polar Security Cutters are getting more expensive.

There is additional risk to the PSC program from competition for works amongst Gulf Coast shipyards for skilled workers.

Bollinger is working to re-baseline the program with realistic milestones.

Parent designs might not be that helpful.

References to foreign built/operated icebreakers are out of date.

No serious discussion of options in foreign shipyards.

STILL NO CREDIBLE DELIVERY DATE FOR THE FIRST POLAR SECURITY CUTTER.

Concluding thoughts:

If you’re new to the world of icebreakers, I highly recommend reading the Congressional Research Service’s Report in full. Ronald O’Rourke does a great job summarizing the issues, despite its lack of good data on foreign icebreakers and foreign shipyard capabilities.

The lack of skilled welders and design engineers in the Gulf Coast region is no surprise to those of you who have been following the discussion on U.S. shipbuilding over the past couple of years. This particular detail adds yet another justification for a U.S. National Maritime Strategy that addresses the lack of ability to build ships within the USA- whether they be merchant vessels, nuclear submarines, U.S. Navy Warships, or polar icebreakers. Recently, there have been some serious discussions about possible partnerships between U.S. companies and foreign shipyards/ship builders. This idea is particularly worthy of consideration when it comes to specialized vessels such as icebreakers.

As always, thanks for reading, subscribing, and spreading the word.

Like by pressing the heart if you want to see more posts like this, and please consider sharing with a friend.

All the Best,

PGR

RADM Jacoby mentioned four shipyards on the Gulf Coast that are competing for key resources but omitted the largest shipyard in the region (Ingalls), who also is competing for the same resources. This is likely to be an issue for some time to come.

These issues with our national shipbuilding problems cry out for a Rickover like personality to take the helm and be answerable to Congress about the status and how he or she is changing the culture and delivering ships and subs on time and close as possible to on budget.

It’s going to take serious commitment, similar to an 8 year tour that the head of NR signs up for but preferably even longer. It should be considered a career so that the person can truly own the program for 15-25 years and watch it grow and prosper under their watch.

We have to do something. The madness of late deliveries and completely blown budgets has to stop.